We are ones to look both ways even when crossing a one-way street. It is ingrained in us to watch for the unexpected. We’re believers in the saying, “It’s the punch you do not see that knocks you out.”

Although we stand in a near fully invested stance at the time of this writing, we are always looking for signals that will change our positioning. Catching our attention at this moment are China’s wealth management products (WMPs). In our last commentary, we briefly highlighted that WMPs may be a potential pain point for the world’s financial markets. We said that the severity of any incident would be dependent on how the Chinese central bank and local investors handle the situation. Their ability to navigate the expected rough waters will indicate whether the incident is contained to China or spreads to a greater portion of the globe.

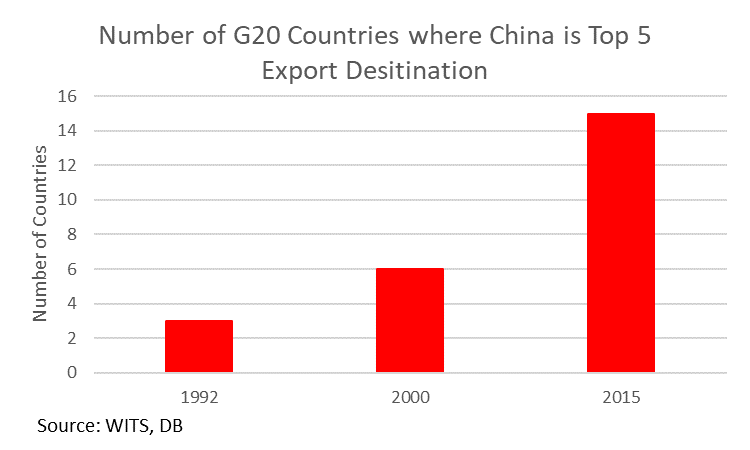

Throughout the 1990s and early 2000s, another saying became popular: if the US sneezed, Europe would catch a cold, and China would be hospitalized. There is a case to be made that the last 10-15 years of strong economic growth in China, as the country became the second-largest economy in the world, requires another version of the expression. The world has benefited from China’s rise — it has become a top-five destination for an increasing number of exports from developed countries. If China sneezes now, the developed countries may be the ones that need to seek medical attention.

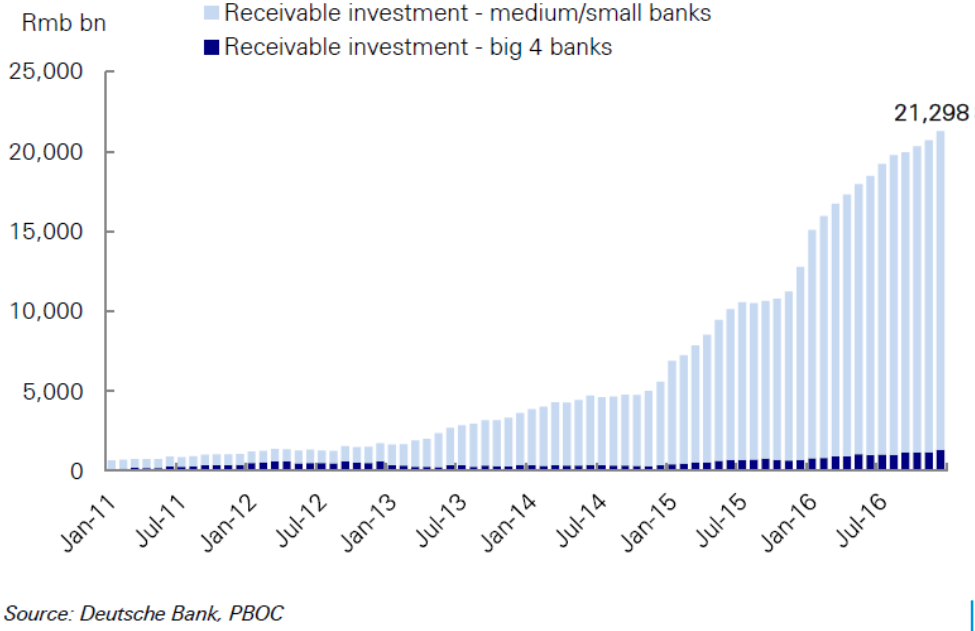

Why are we concerned? We have noticed some warning signs. China has experienced a 43% compounded annual growth in WMPs over the past five years, now totaling $9 trillion in size. We have learned that we should investigate whenever something grows that fast and to that size.

Exacerbating our concern is China’s banking system, which sits at the heart of the issue, making a systemic failure more likely. When the U.S. housing bubble popped in 2008, we saw firsthand the impact of banks sitting in the middle of an asset bubble. We believe there is a risk that China’s banks may be sitting just as precariously as U.S. banks were before the crash. This has not gone unnoticed by Chinese central bankers. They have started a process of reigning in the “animal spirits,” although only time will tell if they can succeed while maintaining a stable economy.

This is no small task and, from our perspective, the probability of success seems low. Bank-originated wealth management products dominate the savings environment for corporations and the newly wealthy in China. To make matters even more precarious, small and mid-size banks use WMPs and leverage to boost their returns.

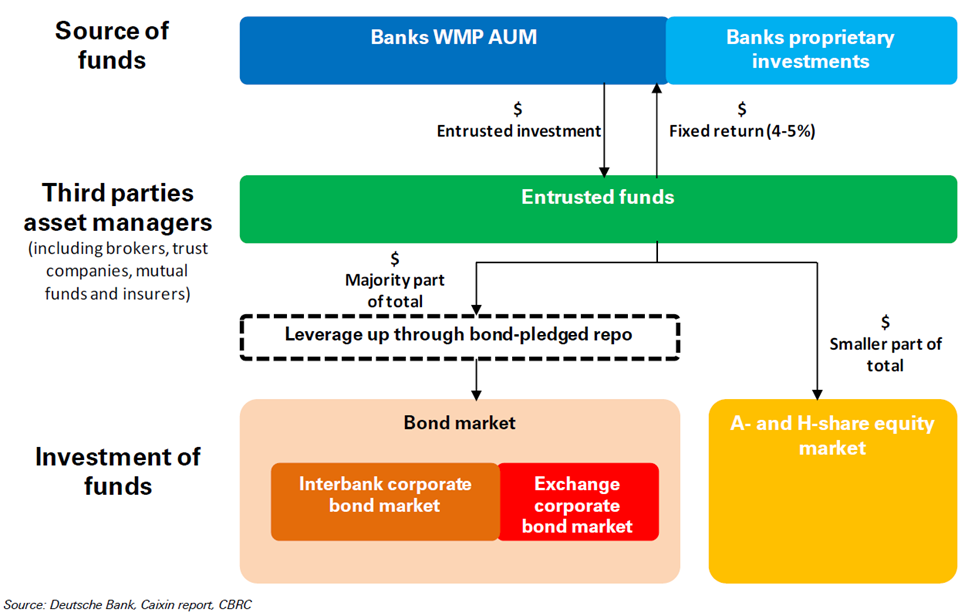

To understand the seriousness of China’s situation, it is important to understand the mechanisms used to arrive at this position. Hans Fan, the China Banking analyst for Deutsche Bank, sums it up nicely:

“[Chinese] companies enjoy ample bank lending resources with low-interest cost. However, the lack of attractive investment projects in their own business prompts them to invest in the financial market (i.e. bank WMPs).

Corporate loans may circle back into the banking system as well. This is because many corporates use borrowed but idle cash to buy bank WMPs. Below is a simple example:

Firstly, Bank A makes a loan to a corporate.

Secondly, the corporate uses the loan proceeds to buy a wealth management product issued by Bank A.

Thirdly, Bank A invests the WMP fund in a financial bond issued by Bank B. This corporate deposit would circle back to the banking system as a non-core liability.

To make this process economic, in many cases it would require leverage. The corporate borrowing cost may be at 4%, but the financial bond issued by Bank B may only yield 3.5%. To compensate the yield shortage, Bank A has to entrust the WMP fund to a third party and to leverage up by pledging the bonds through repo transactions. This process is called entrusted investment (“Weiwai” in Chinese, or entrusting to an external party).”

If your head is spinning right now, good. It should be. The takeaway is that Chinese banks are performing the dangerous act of placing leverage on top of leverage, or in other words, borrowing money to buy more borrowed money. All is fine and good when the assets being leveraged move up in price. A problem only arises when asset prices fall, causing a panic and a run for the doors. And as we saw in the US mortgage bubble, the initial decline in price does not need to be large.

Let’s look at a simpler example. Jim gets a loan from First Bank but has no need for the money, so he asks First Bank to place the funds into their “enhanced savings” fund. Jim is paying a 4% interest rate for the loan and the bank is telling him that he can invest it with them and get a 6% rate. Jim loves the idea of risking no money and getting a check every month. Who wouldn’t?

The issue is First Bank needs to invest Jim’s money in a method to provide Jim with that 6% rate plus get their fee (remember, the Bank is looking at this as a means of making money). However, the only assets available for them to purchase provides a 3.5% return. Seems like an insurmountable problem, right? Not for an investment banker!

First Bank figures out that they can “entrust” the funds to an outside party (Weiwai) that provides the desired high return by buying more of the low return assets than they have funds to do so, i.e. using large amounts of borrowed funds themselves to make up the difference. You may be asking who would lend them the funds to buy more than they can afford. First Bank, of course!

Complicated? Yes.

Profitable? Kinda.

Stable? Absolutely not.

These entrusted funds, Weiwai, are the primary players in China’s shadow banking ecosystem. Unregulated, they allow banks to entice people into savings products that people expect to be backed by the government when, in fact, the products are not. The banks promise WMP liquidity when the fact is they are invested in less liquid assets. A pre-requisite for a run-on-the-bank episode.

Is this a long-standing issue or is it relatively new? We will let the following graph answer that question. (Note: Weiwais are represented partially in a bank’s balance sheet as “receivable investment.”)

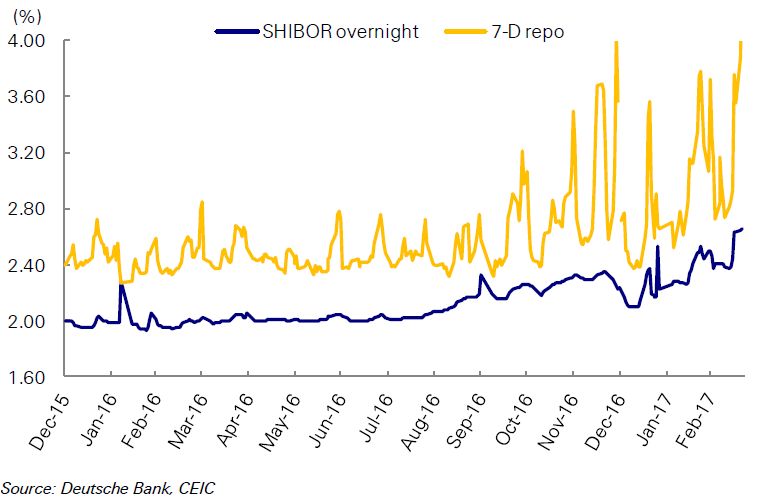

Though the Chinese central bank provides some detail that suggests a potential problem, it does not offer the transparency needed to understand the level of leverage that has been built into these products. And even if the central bank were transparent, it would be difficult to forecast how investors will react when things get sloppy. We know from our own experience that shocks can come out of nowhere and cause significant disruption to the economy and individuals’ assets. We hope people around the globe have learned from the United States’ mistakes; there are some signs the China central bank has taken our past issues to heart. In late fall of 2016, they started a process to reign in the banking system. Though data is cloudy to date, we are seeing increasing volatility and pricing in local bank interest rates, suggesting that banks are under some strain to find funding for their balance sheets. Time will tell if China can produce a soft landing for this build-up of debt.

We understand that this is a complicated story to tell and hope that we shed enough light to aid your understanding of a potential tail risk. We believe we developed our risk models to catch such an event and to understand the severity of the shock it could cause on a global level. For now, instead of looking just left and right when crossing the proverbial street, we will also look up and down.

[…] state-owned corporate space and was funded through the internal savings of the population. We have written about the rapid growth in WMP’s and the expected guarantee of their savings by the central […]