Inflation is on everyone’s mind and energy pricing has been a significant contributor. We have been discussing our concern that inflation has taken on a more structural ‘feel’ versus being transitory from the pandemic re-opening process.

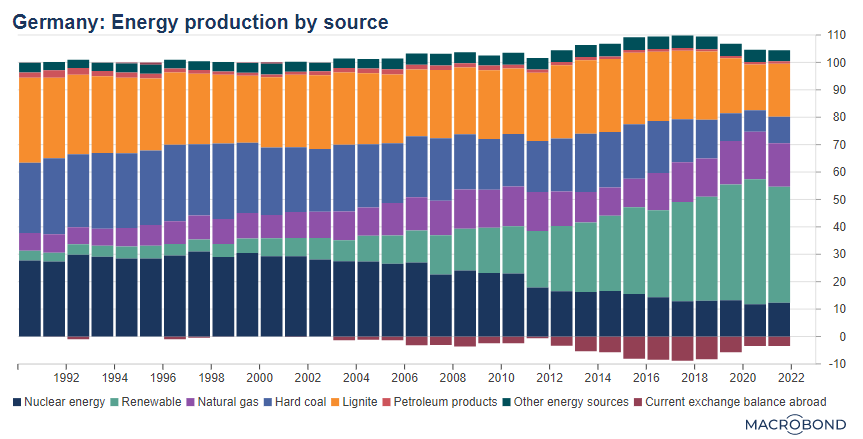

Supporting this argument is the impact from an aggressive move to renewable energy as demonstrated by Germany. The graphic below shows the changes within German energy production. Since the early 2000’s, Germany has been driving an aggressive campaign to renewables, taking share of production from base-level sources such as nuclear and fossil fuels.

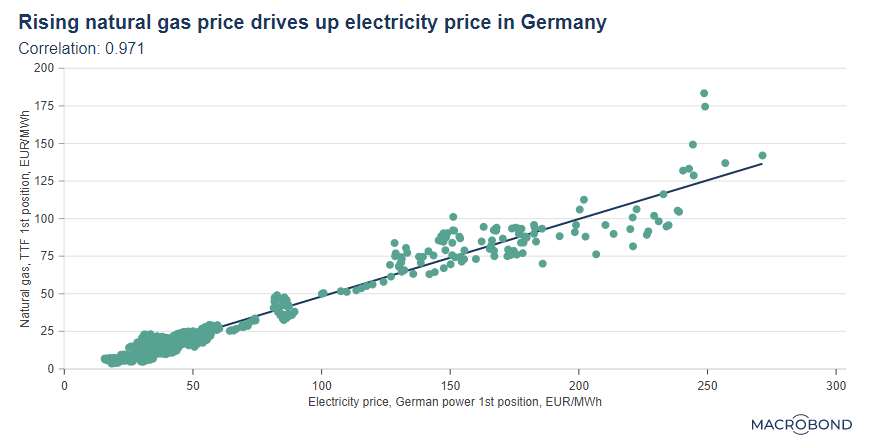

This has resulted in Germany power prices being among the highest in the world and, perversely, increasingly dependent on the pricing of fossil fuels as depicted in the scatter plot below.

This has resulted in Germany power prices being among the highest in the world and, perversely, increasingly dependent on the pricing of fossil fuels as depicted in the scatter plot below.

As investments within the fossil fuel space continue to languish as major sources of capital (sovereign wealth funds and pension funds being two examples) reduce their investment into the space, it is not obvious how this move to higher energy pricing abates.