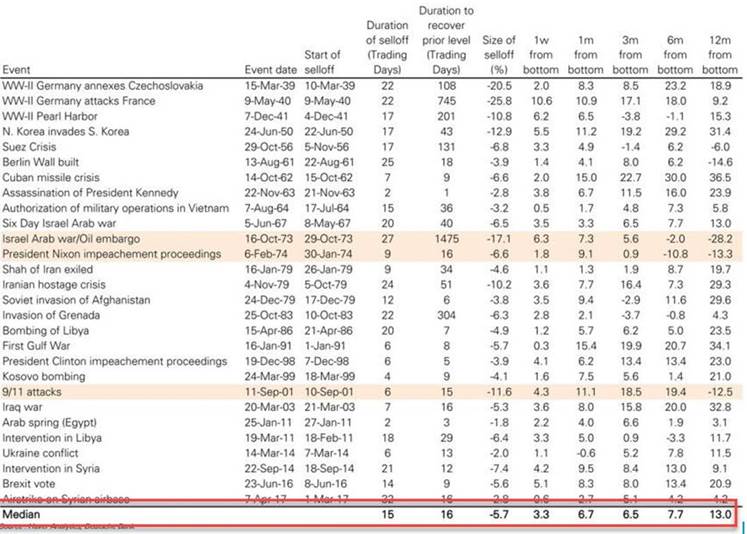

Geopolitical events, especially wars, bring incredible destruction to those directly involved, and unfortunately, the impact will be felt for many years or decades. For global investment markets, though, the empirical evidence suggests that the impact may be short-lived. The investment bank, Mizuho, has published a look back at the larger military events since WWII with the data provided below.

Though the initial shock can be alarming, the longer-term market returns from the point of incursion suggest that the market builds into prices the threat of war before the actual war starts. It is not foolproof as there were times when the market did not fully incorporate the value destruction. The three events (shown above) where the markets continued dropping were post the 2000 technology bubble and the periods involving the OPEC oil embargo. It should give us pause that those have some commonality with the situation we face ourselves today.

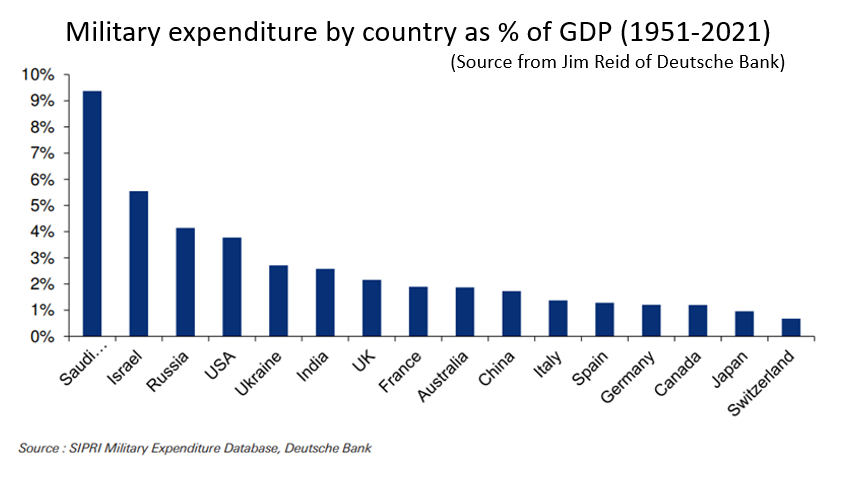

The Russian invasion into Ukraine is looking to take on a more lasting impact. Not entirely due to the war but the change in attitude of European leaders. Western Europe’s willingness to placate Putin and to become increasingly dependent on Russia for commodities appears to be ending. European countries had become complacent to the threats of aggression from their eastern neighbor. The last two weeks have signaled a change in that attitude as Germany and other NATO members announced a significant drive to increase defense spending. The graph below shows the average spend on defense by various countries. In the case of Germany’s announcement, they will be doubling their spend.

It should go without saying that we hope that peace will prevail sooner rather than later. The drop in global markets may be short lived but the impact of a changing economic focus by Western Europe is likely to bring about a more lasting result, promoting a stronger defense against authoritarian regimes.