“The boiling frog story is a wide spread anecdote describing a frog slowly being boiled alive. The premise is that if a frog is placed in boiling water, it will jump out, but if it is placed in cold water that is slowly heated, it will not perceive the danger and will be cooked to death. The story is often used as a metaphor for the inability or unwillingness of people to react to significant changes that occur gradually.” – Wikipedia

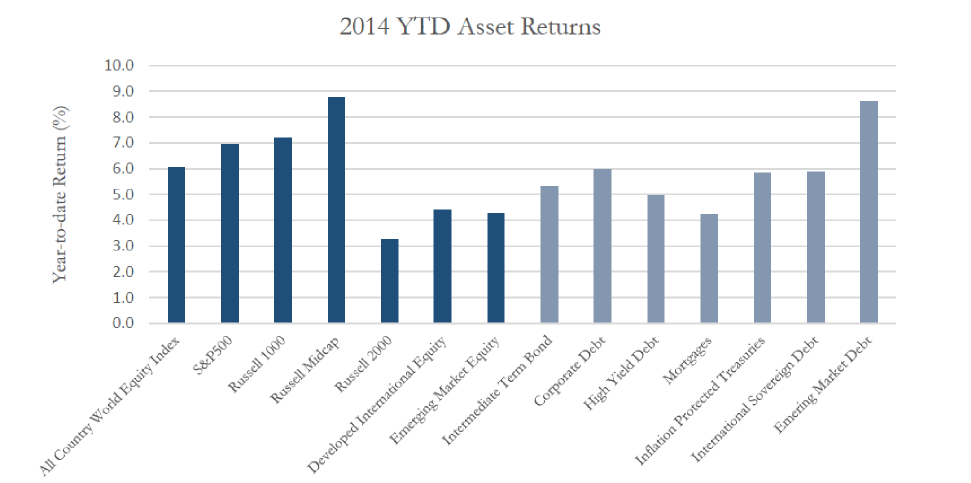

“Sell in May and go away” is a phrase heard by many as a common belief that the stock market typically weakens during the summer months. Following this strategy in the current year would have been detrimental given the market strength seen to date. The proprietary Auour Regime Model (“ARM”) is taking the boiling frog analogy and turning it on its head. The model is keeping us in the market to its full extent with a bullish risk signal. The water is at a slow simmer, but it’s the bears who are being cooked. Putting the February rebound from the poor January aside, the last two months have been the strongest for the equity market so far this year.

The bond market is indicating that economic progress will continue to grind ahead with high yield bonds outperforming and credit spreads contracting. Consumer confidence, which is among the most important drivers of a recovery, is outpacing estimates. Existing home sales (4.89 million actual v. 4.80 million expected), new home sales (504,000 actual v. 440,000 expected), consumer confidence (85.2 actual v. 84.0 expected), and Michigan Sentiment – Final (82.5 actual v. 81.7 expected) continue to indicate an improving macro backdrop. Emerging markets and small cap equities had a strong May and June – also indicating better future economic progress. Auour risk premium model (one of the many factors used to build ARM) which compares implied market volatility to realized market volatility, signals a fully-invested stance is appropriate. Though market returns continue to drive confidence in our work and conclusions, we are not complacent. With that said, some of the things that we are watching.

Dubai Equity Market

The Dubai Stock market has experienced wonderful growth over the past year on news that it would graduate from the Frontier Markets and become an Emerging Market. Despite this good news, it has recently experienced a 23% decline over the past two months on fears of an overheated real estate market and increasing tension within the region. Seeing small fringe markets (hopefully no hurt feelings from our Dubai readers) come down quickly highlights a potential reduction in market ebullience. Our ears are perked but Dubai has experienced downdrafts such as this eight times since 2008.

Emerging Market Debt

As the emerging market economies represent almost half of the world’s economic activity, it should come as no surprise that we also perked our ears at the Bank of International Settlements’ report on the growing level of debt issuances within the emerging countries. According to their estimates, over $2 trillion of debt has been issued since 2008. The global hunger for yield has driven up the demand for their debt. This is, with little doubt, producing bubbles within some countries and assets. The biggest concern we have is that one of those asset bubbles appears to be in real estate. As we know from history, the worst bubbles are those that consist of non-productive assets (such as residential real estate) as lower prices for the assets does not allow for an increase in productivity.

Mergers & Acquisitions versus Business Investment

Global deal activity reached $1.7 trillion for the first six months of the year, a 75% rise over last year and the highest since 2007. Low organic growth combined with cheap and easy credit is driving business leaders to stretch for acquisitions. It may not turn out to be an issue, but we are watching as we see investment capital go towards merging existing businesses versus building new one.

China Metals Fraud