Emerging Problems

“I think we can’t learn clear lessons from history. What we can learn is to watch out for dangerous possibilities.” – Margaret MacMillan

At Auour, we analyze many independent factors to assess greed and fear and the inherent risk in the global markets. We believe the tools we have honed give us a more balanced approach to global investing and provides us the opportunity to gradually move allocations – potentially to all cash – as our confidence builds that a material and enduring downturn lies in front of us. Based on our analysis, we expect to hold some cash about 15% of an investment cycle and move the portfolios to 100% cash about 3% of the time. We see ourselves in the former and do not, at this time, see us entering the latter.

To say the factors are independent may be going too far. With the same market participants playing in all global markets, any asset’s movement might at least indirectly impact others. Therefore, we have devoted a segment of Auour’s models to interaction factors to determine when localized disturbances turn into larger and, potentially, more enduring problems.

In our writings and conversations, we typically highlight areas that concern us. We look to identify issues to see if they have the magnitude and momentum to cause a global softening. In many cases, such as with Brexit, we witness momentary events that inflict pain on a certain segment of the market (in this case, Britain) but are not so impactful as to do harm to the global economy.

Our concerns today feel different.

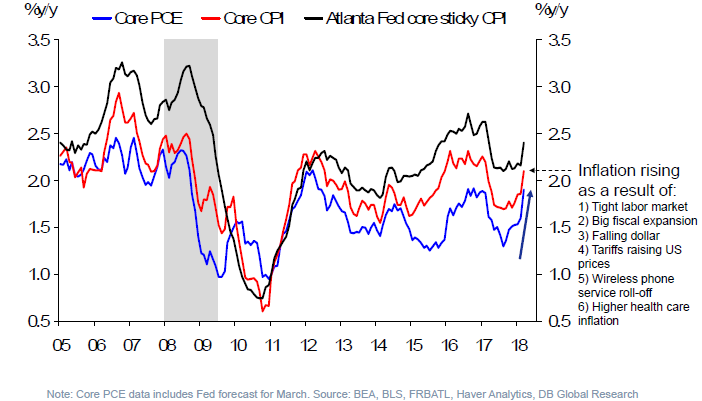

We have previously shared our fears about how increasing inflationary pressure will impact interest rates. After a three-decade bond bull market of ever lower rates, we are now two years into a rising rate environment. Up to this point, we and others have thought that it was a necessary adjustment because rates had become disconnected from their underlying drivers. Money was too easy, and the central banks needed to reduce the money supply as the economy recovered—a rational move.

However, the abrupt adjustment in rates in late January brought about a spike in volatility in the global equity markets. That has faded to some extent, but the continued rise in rates is showing up in an increasing number of asset classes, thereby elevating our concern that this may be the start, albeit in the early stages, of something material. And enduring.

We want to highlight a few areas where we see cracks forming that could turn into material dislocations later.

A Deceleration in Global Growth

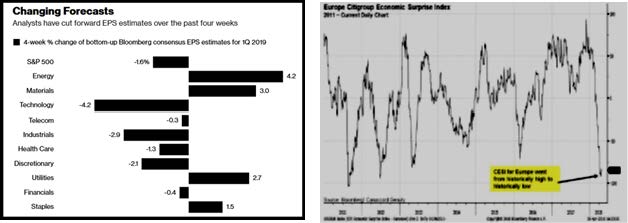

Though the global economy continues to grow, we have recently seen a deceleration of growth and a lack of vigor in the leading economic indicators, which is unsurprising since we are now in the second longest economic expansion in U.S. history. Markets will need to adjust to a changing growth posture—rarely a pleasant event. In the last few months, we have seen earnings expectations becoming more moderate in the U.S., and we have seen Europe lose its ability to surprise on the upside. Neither observations are signs of an immediate and material downturn, but they do increase the probability that we have seen the best for this cycle.

A Growing Disconnect

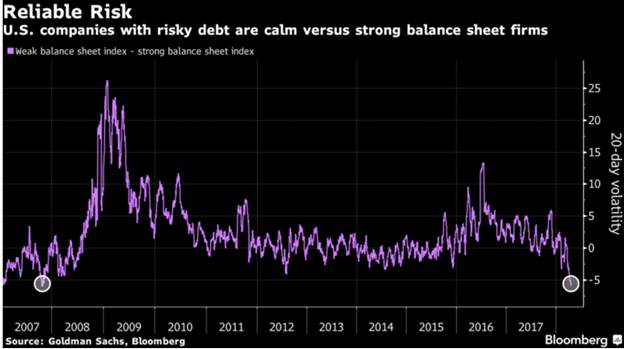

This slowing of the economy, if it persists, could be rough when coupled with the complacency in the bond markets. The market’s reaction within the various segments of the equity markets has been eerie: We have witnessed a relative calm in debt-laden companies compared to those with more pristine balance sheets—not something one would expect as the cost of debt increases.

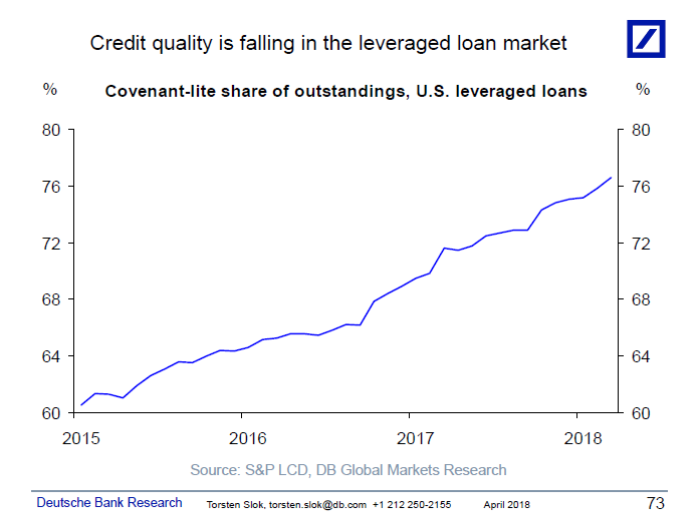

This phenomenon has some themes in common with other extended credit cycles, where optimism built within the debt-heavy sectors even as the risk in those debt instruments increased. Today, we are seeing a growing percentage of debt that carries easier terms (a.k.a., covenant-lite leveraged loans), as shown in the graph below. Add to this the increasing default rates in auto and student loans, and one could make an argument for increased caution.

Weakening Currency Markets

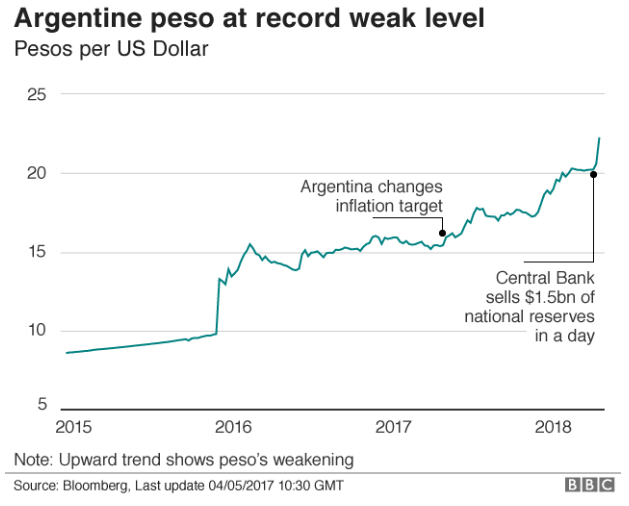

Was it Mark Twain who said, “History doesn’t repeat itself but it often rhymes?” We concur. As seen in past rate-rising environments, the U.S. dollar has strengthened, putting pressure on emerging markets as they struggle to find dollars for trade and they experience rising debt servicing costs on their dollar-denominated debt (which is very high at this point). You can read more about that issue here. Because of this, their currencies will show increasing levels of stress. In some cases, those events have predated market turmoil. We are seeing this now as Argentina and Turkey experience significant depreciation of their currencies. Brazil, too, is feeling pressure from the recent dollar strength. We are watching to see if their weakness is infectious.

Conclusion

Many of the areas of weakness we see today have also happened together in the past, as U.S. dollars became harder to find and more expensive to obtain. This combination of weaknesses rarely leads to the severe consequences we experienced in 2008, but it has typically resulted in a rough consolidation period. We think we are in one of those now. Some economists think a change has occurred with the relationship between investment cycles and economic cycles. In the post-WWII period, economic recessions (a period of reduced consumption and capital investment) would lead to market downturns. Now, they believe that corrections in asset prices (a contraction in the investment markets) will cause economic downturns. We believe that thought has merit.

We believe that the factors incorporated into our views, and our investment model, fit well with this changing landscape. Due to our readings, we are positioned conservatively. Our equity strategies have reduced market exposure and hold between 15-20% cash. Our balanced strategies hold below-benchmark equity exposure. And our fixed income strategy holds little of the higher risk bond categories. We started down this path at the market highs in January and we continued to follow it over the past few months. Until our models provide an ‘all-clear’ signal, we will remain in a mode of protecting capital and dampening the market’s volatility.