Auour Investments is dedicated to providing Financial Advisors with quality investment solutions tailored to the needs of their clients.

Empirical evidence suggests that investors become risk adverse out of regret and often at the worst times. Auour developed the Instinct Strategies in an attempt to eliminate that regret. With a clean sheet of paper, we designed the Instinct family of strategies with the intent to drive superior performance by protecting wealth during market panics.

The Auour Instinct Strategies rely on the experience built from decades of institutional investment management and are designed to participate in rising markets while protecting capital during falling markets. Leveraging the efficiency of exchange traded funds (ETFs), Auour focuses on those facets that have been shown to drive investment performance:

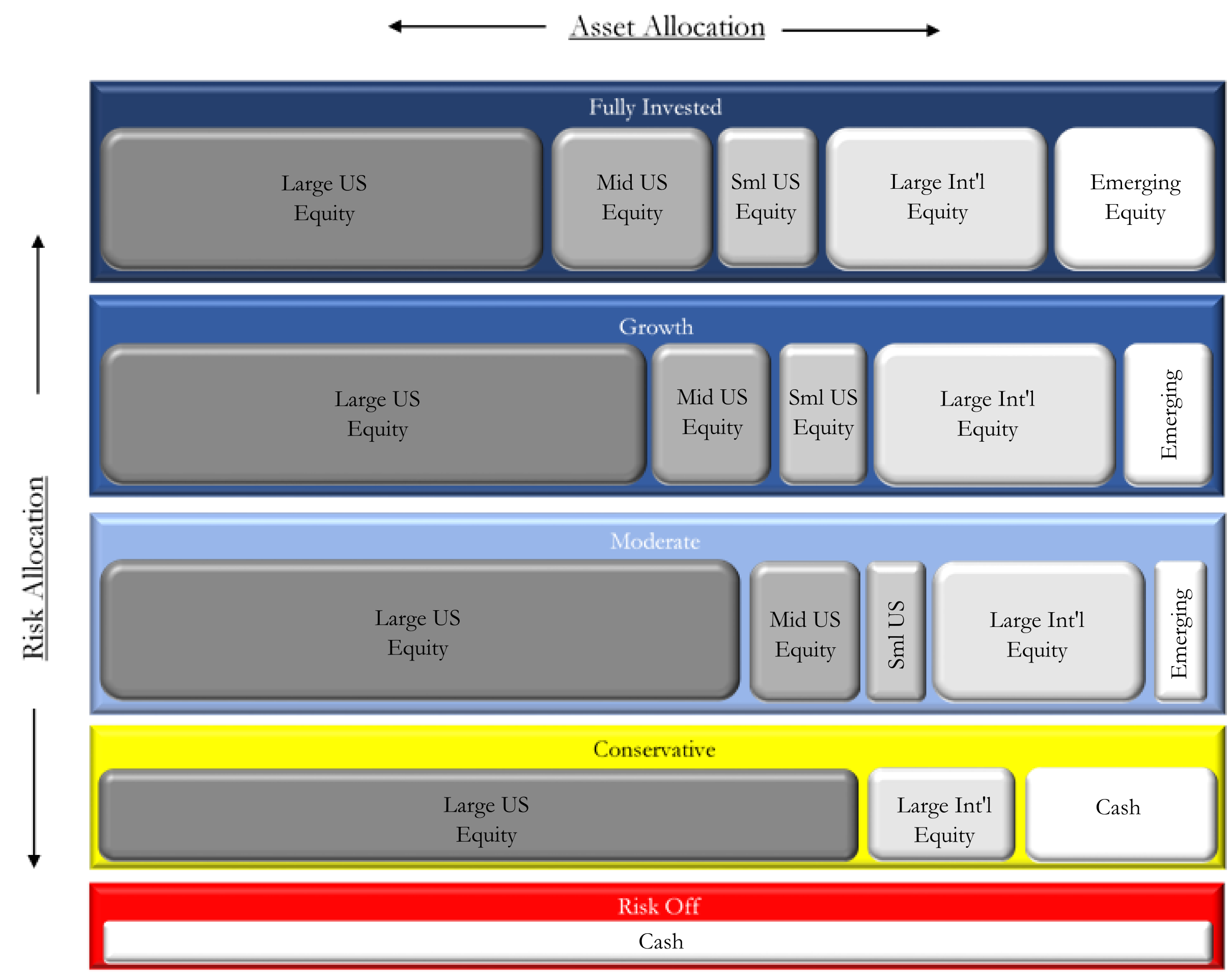

The strategies incorporate portfolios with varying levels of risk and return objectives to best fit the needs of your clients. Using the same core philosophy across all products, the Auour technology platform automatically adjusts the composition of the individual portfolios to maintain exposures consistent with the underlying strategy.

Auour maintains a proprietary multi-factor model that analytically characterizes markets across a spectrum of risk. We call it the Auour Regime Model (ARM). Using a combination of fundamental and technical inputs, Auour estimates the investment environment and adjusts the asset allocation to best fit the market conditions. The factors consist of:

We believe these factors help us to critically, and with a higher level of accuracy, gauge the spectrum of fear and greed that exists within the various financial markets of the world.

Auour differentiates itself through the use of the Auour Regime Model. This model identifies the various market regimes and dynamically allocates assets to align with market conditions. This process allows us to look at the world from both an asset allocation and a market regime perspective. By separating the two decisions, we believe we offer a more durable solution to financial advisors to protect client assets during down markets and to maintain performance in rising markets.

All strategies utilize the qualitative and quantitative strengths of our risk regime characterization process that was developed to protect clients’ wealth through down markets. Incorporating sophisticated quantitative modelling, logic, and hard empirical data, we have developed what we believe to be the next generation of downside protection portfolio management.