“Nature, to be commanded, must be obeyed”

– Sir Francis Bacon

One quote, two stories, and then the point to this newletter.

This quote from Sir Francis Bacon sticks in our minds a lot these days. It fits so many situations as we see numerous examples of people putting their intentions before reason. This leads us to two stories.

We live and work in horse country. The North Shore of Boston has almost as many horses as people (stretching the truth a little). Seeing riders on the back of horses is fantastic. Watching a skilled equestrian is an amazing experience, noting the level of communication that is demanded for this symbiotic relationship. The horse is much more powerful than its rider and has its own mind. It does not exist for the benefit of the equestrian. However, it does, in most cases, do what a skilled rider asks of it. The tug on the lead here, the jab of a spur there, the clicking sound at the right point can all have an impact on the actions of the horse. Each horse is unique, with different actions required to take charge of its movements. The Bacon quote referenced above resonates strongly in this situation. For the rider to command the performance of the horse, they need to respect, respond, and obey the actions of the horse.

Our second story is also relevant. I was recently required to attend a parent drivers’ education class. (Not because of poor driving habits, but because I am the parent of a teenager that is close to getting her license). In Massachusetts, we have a graduated drivers license for teenagers where their right to drive with others in the car or at night expands with age and experience. As the instructor explained the expanding driving privileges of a teen driver, he highlighted something that should have been obvious. He explained that the state adopted this process because newly licensed teenagers suffer from a dangerous combination of overconfidence and lack of experience. (Nothing like putting an inexperienced “know-it-all” behind the wheel of a car)

And now to the point of this newsletter. Financial markets are viewed by many as something to be exploited rather than respected, very much unlike the view an experienced equestrian has about their horse. Financial markets at the same time include a large number of participants who have little experience or knowledge of the financial ecosystem, yet have an abundance of confidence. Just like the newly licensed teenage drive, the investor’s confidence is not deserved given the consistent underperformance they experience. This combination makes for a dangerous financial outlook that should, and can, be avoided.

At Auour Advisory, we promote the advantages of low-cost, passive investments. We actively monitor the inability of most active investment professionals to ‘beat the market’. Because of the constant drumbeat of passive investment vehicles coming from us, an incorrect perception may present itself that such investing is easy and that anyone can do it. That is obviously not our point. Much like the tension inherent in Bacon’s quote, investing can require a balancing act.

The financial markets can only be trusted if one understands them. In this financial world, however, few take the time to do this. They succumb to greed and fear and take those feelings to the extreme. It leads to market inefficiencies. Some times at the macro level (country, style, asset class) and sometimes at the micro level (individual investments within an asset class). At Auour Advisory, we expend resources looking for those unique instances where fear and greed have influenced an investment category. We do not suffer from hubris thinking we can detect and act on all of them. What we do, however, is attempt to find and explore them. We assess our level of confidence of an inefficiency and determine if our ability to act on it will lead to outsized returns.

This may not appear much different from the processes of other investment managers, but in practice is almost 180 degrees from their actions. The difference is evident from the onset of our investment process. We approach the investment world as if most markets are efficient and address that part of the market with low-cost, passive investments. We then “look through the haystack” for the right opportunity in selected inefficient markets. Our competitors come from the perspective that the entire world is inefficient and overspend to access the total market.

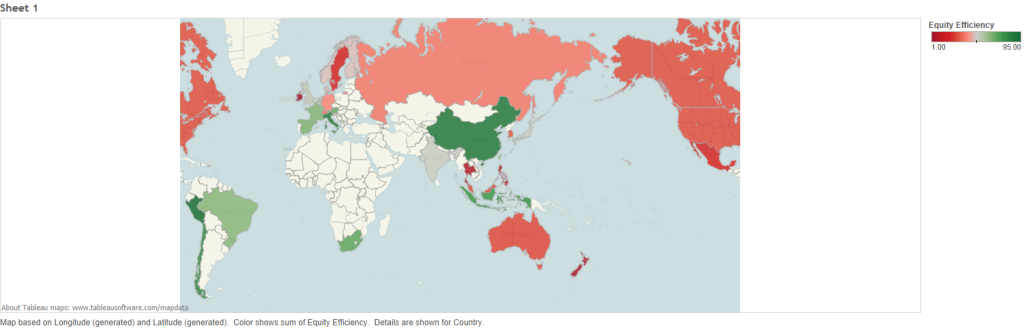

At the core to our analytical process is the mapping of the various asset classes that exist around the world. We measure, through proprietary analytics, their level of efficiency. If the market is highly efficient, meaning investment managers have demonstrated little skill to outperform, we spend no time trying to outperform in that market. Instead, we focus our attention on the areas where our model suggests inefficiency.

focused only on the large company segment of the market. It is for illustrative purposes only.

As an illustration, the graphic above suggests that most equity markets, especially in North America, are highly efficient (the darker the red, the more efficient whereas green suggest opportunities to add value above market returns). Our model suggests that Asia and Latin America are areas for us to pursue a more active approach. For Auour, that means evaluating our ability to manage the effort internally or find a manager that can cover their costs and deliver better than market investment returns.

As we have stated before, we are not wedded to any idea, philosophy, or process except for our drive to build our clients’ purchasing power. We are constantly evaluating the financial market landscape and patiently waiting for opportunities that provide a high level of confidence.