“Half a century of analysis has yet to fully answer why investors place such a large proportion of their funds with active equity managers, given the discouraging evidence on the latter’s ability to add net value”

– Rotman International Journal of Pension Management

With this being our inaugural newsletter, it seems fitting that we open with one of the principal elements of our strategy: the active use of low-fee passive investment vehicles. The above quote came from a recent research article examining why so many investors continue to follow a strategy that has consistently shown to be expensive and to produce poor results. However, before we delve into the psyche of the investor, it seems important to explain the investment realities.

Active investment management is a process by which investment professionals buy and sell individual securities attempting to outperform their benchmark in order to justify fees. Passive investment management, pioneered by John Bogle and his investment firm Vanguard, is the process of investing directly in a benchmark at minimal costs. The philosophical differences are vast. With active management, investors will attempt to analyze a large portion of available investment opportunities and select opportunities they believe will outperform. They will invest in these securities in amounts that they believe will produce above-market performance, without taking on excessive risk. Passive investing, on the other hand, accepts that the market is mostly efficient. A passive investor believes that by owning all of the market participants, they will produce the desired return without needing to deviate from the risks of the market.

The debate between the merits of active versus passive investing has been ongoing. However, the facts (actual historical returns) overwhelmingly suggest that active investing cannot add value above the returns of passive strategies. Research shows that individuals that attempt to beat the market cannot do it consistently. Vanguard has produced studies which show that more than 85% of managers underperform their benchmark. This number is even higher in certain asset classes and investment styles. In addition, the fees associated with active managers can far exceed (by 10 times or more) the fees of passive investment vehicles.

There is value, however, to be obtained from investment professionals. It revolves around the fact that inefficiencies exist in certain asset categories at certain times. This situation is the primary reason why Auour has approached the market with our strategy. We focus our efforts on areas that impact performance such as asset allocation and the identification of inefficient asset categories. We evaluate global assets to identify where active managers are unable to outperform and find discontinuities in asset class valuations. We use low cost passive strategies where applicable, but are also willing to acknowledge inefficiencies that may require the select use of active management. Our belief is that we can lower costs and outperform an active-management strategy. Our ultimate goal is to increase our clients’ purchasing power over that of others.

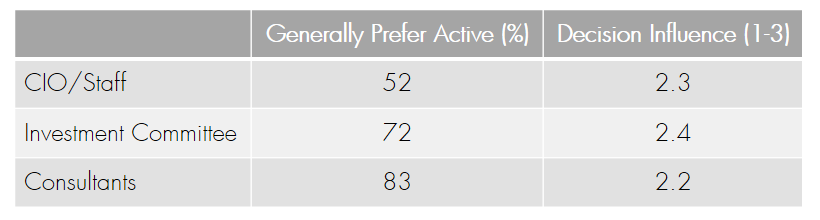

The benefits of our investment philosophy may be self-evident given the research. However, many investors continue to spend effort, money, and opportunity cost in futile attempts to find the next outperformer – therefore we believe our approach is still highly differentiated from most other investors. The table below shows how market participants view active management. We truly wonder why the interest in active management is so great. We also note that the closer an individual is to fiduciary responsibility over investment assets, the greater the likelihood that they prefer passive management.

*Rotman International Journal of Pension Management, Volume 6, Issue 2

Let us summarize the research mentioned at the beginning by Bird, Gray, and Scotti of the University of Technology, Sydney. Their analysis focused on why, with all the evidence that active managers cannot outperform, investors still choose active management. To gain insight into this conundrum, they conducted surveys of both Chief Investment Officers of large pension funds and investment consultants that assist in the selection of investment strategies. Their broad conclusion from their work is that the ‘rational evidence-based framework’ adopted by the stewards of capital is undermined by:

The influence of the consultants whose business depends on offering manager selection advice (funny how that is…)

Behavioral impediments such as “overconfidence and illusion of control” pushing decision makers toward excessive levels of activity

Society’s affection for ‘doing something’ and seeing passivity as a weakness

This research further analyzes the findings outlined above. We will refrain from going any deeper into this article, but are happy to discuss our thoughts with anyone that finds this interesting or provide the full text of the research paper. Our main takeaway is that there is a real inefficiency in the market. However, this inefficiency is not in the pricing of individual securities that make up the market. The inefficiency lies within the strategies of investors consistently seeking, to no avail, market-beating returns from, at best, mediocre managers.

Auour is motivated to change this paradigm. We focus our attention on the areas that have demonstrated a better chance to improve results and do so with a keen awareness of costs.